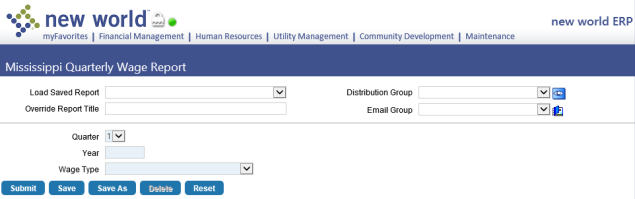

Mississippi Quarterly Wage Report

Human Resources > State Requirements > MS > Quarterly Wage Report

The ![]() Quarterly Wage Report has been added to the Mississippi State Requirements menu. Use this option to generate a report and transmittal file of quarterly wage information to be filed with the state of Mississippi each quarter. Wage information is based on check date.

Quarterly Wage Report has been added to the Mississippi State Requirements menu. Use this option to generate a report and transmittal file of quarterly wage information to be filed with the state of Mississippi each quarter. Wage information is based on check date.

| Field | Description |

|---|---|

| Load Saved Report | Saves this version of the report as a template for later use. When you click Save, a dialog will ask you to name the report. Type the name, and click OK. The next time you want to run this report, select its name from the Load Saved Report drop-down, and the fields will be populated automatically. If necessary, you may edit entries before running the report. You may save as many templates as you would like. |

| Override Report Title | Overrides the default report title, (Mississippi Quarterly Wage Report). |

| Distribution Group | A group of people selected to receive the report in myReports. Click in the field to select from a list of existing groups, or click the blue-eye prompt  to create a new distribution group. The report will be sent to myReports for each person in the group. to create a new distribution group. The report will be sent to myReports for each person in the group. |

| Email Group | A group of people selected to receive the report by e-mail. Click in the field to select from a list of existing groups. To create a new e-mail group, click |

| Quarter | Required. Identifies the fiscal quarter being reported. The available selections are 1 (Jan.-Mar.), 2 (Apr.-June), 3 (July-Sept.) and 4 (Oct.-Dec.). |

| Year | Required. Identifies the year of the fiscal quarter being reported. Type all four digits of the year. The current year is the default. |

| Wage Type | Required. Tax code set up for quarterly wages. Click in the field to select from a drop-down of available codes. The drop-down includes all tax codes, regardless of active date or status. The gross will be taken from the selected tax. All employees who have the wage type selected during the quarter selected are eligible. |

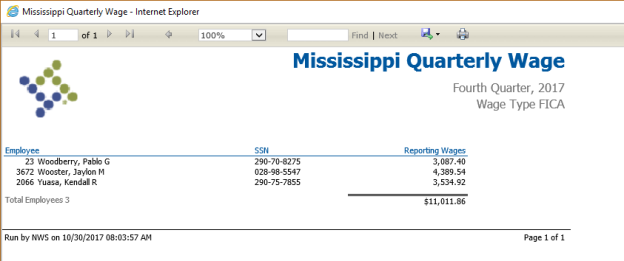

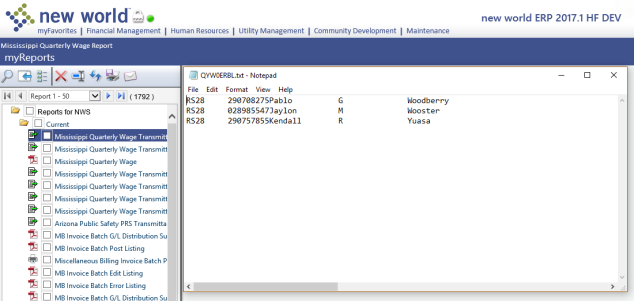

After making your entries, click Submit to generate and display the report. A transmittal file of the report data also will be sent to myReports. If you want to submit a PDF of the report data to myReports, click the Send to myReports button, located in the top-right corner of the report display.

On the report output, the quarter and year reported display directly below the report title. The report body is sorted alphabetically by Employee name and contains the following columns of information:

- Employee

- SSN

- Reporting Wages (If SUTA is used, the amount equals gross + excess wages)

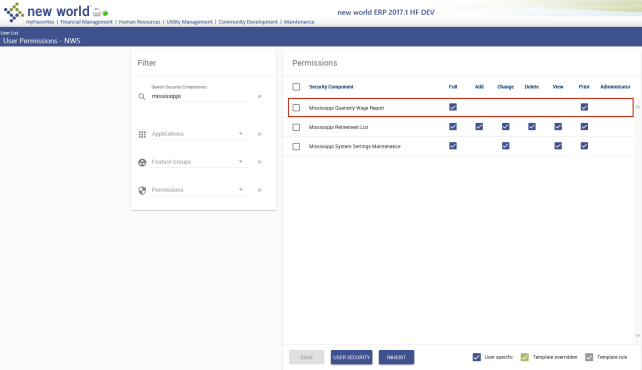

Note: A ![]() Mississippi Quarterly Wage Report security component exists for this option. Navigate to Maintenance > new world ERP Suite > Security > Users, give permission to each user who should have access to this option, and click SAVE to retain the settings. The new authorization takes effect once the user has logged off and back on the system.

Mississippi Quarterly Wage Report security component exists for this option. Navigate to Maintenance > new world ERP Suite > Security > Users, give permission to each user who should have access to this option, and click SAVE to retain the settings. The new authorization takes effect once the user has logged off and back on the system.